TSMC's enhanced 3nm process node (N3e) to start production a quarter ahead of schedule

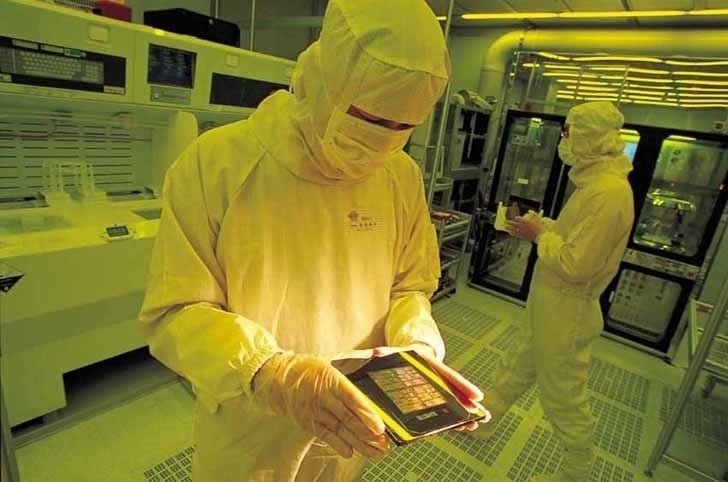

TSMC and Samsung are the only two foundries right now that are moving closer to producing chips using a 3nm process node. While TSMC plans on continuing using its FinFET transistors for 3nm, Samsung plans on using its GAA (Gate-all-around) architecture for 3nm. According to Wccftech, Wall Street powerhouse Morgan Stanley says that TSMC is moving the production schedule for its enhanced 3nm process node (N3e) ahead by a quarter.

Financial giant says TSMC's enhanced 3nm yields have been higher than expected

Morgan Stanley says that the production yield for this node has been higher than expected and the foundry might freeze the design of the N3e node by the end of this month. Part of the report was posted on Twitter by a user with the handle RetiredEngineer who took from the financial giant's report that volume production for the N3e process node may start during the second quarter of 2023 rather than the third quarter.

TSMC's enhanced 3nm node will start production a quarter ahead of schedule

According to Morgan Stanley's report, the logic density of TSMC's N3e process node is approximately 8% less than the original N3 with four fewer EUV layers. The EUV machine uses ultraviolet beams to help create circuit patterns on wafers. Considering how many transistors fit inside a chip these days, these circuit patterns need to be extremely narrow as do the beams that create these patterns.

Initially, yields on TSMC's N3 chips were rumored by the media in Taiwan as being too low. This means that the number of chips on a wafer that failed to pass quality control was too high. These reports included a rumor saying that some TSMC customers decided to stick with chips built using the 5nm node because of the low yield on N3.

Moving production of the N3e mode ahead one quarter has no impact on the production of the original N3 3nm chips. TSMC is still expected to start production of N3 chips beginning in the third quarter of this year and deliver them to customers in the first quarter of 2023. Chips made using TSMC's N3 or N3e process node, or Samsung Foundry's 3GAE node are not expected to be on the market until the third or fourth quarter of 2023.

During a recent conference call, TSMC's chief executive officer Dr. C.C. Wei said that the N3e node will ""feature improved manufacturing process window with better performance, power, and yield." This makes sense since that is the enhanced version of 3nm that he is talking about.

While TSMC remains the top global foundry, its main competitor has a problem. Samsung has reportedly started investigating fraud as certain Foundry employees were accused in the Korean media of overstating the yields on their 5nm chips.

Samsung Foundry's yield at 4nm node was half that of TSMC's

The reason to do this was to make it appear that things were going along swimmingly for Samsung because funds that were supposed to be used to improve the unit's yield have gone missing. For example, the yield for Samsung Foundry's 4nm node was a low 35% compared to a 70% yield for TSMC's 4nm node. The disappointing yield numbers led Qualcomm to switch and it will now have TSMC manufacture its next-generation flagship Applications Processor (AP) which we assume will be called the Qualcomm Snapdragon 8 Gen 2.

Low yields could result in a shortage of certain chips from a specific foundry. Mixed in with the current chip shortage, Samsung Foundry's low yield spells trouble for the business in what is a competitive sector of the chip industry. Qualcomm returned to TSMC to build the Snapdragon 855 and Snapdragon 855+ and stuck with the foundry for 2020's Snapdragon 865 and Snapdragon 865+.

But last year the Snapdragon 888 was manufactured by Samsung as is this year's Snapdragon 8 Gen 1. And now the pendulum has shifted to the other side and while that might have happened at some point anyway, Samsung has caused its own problem thanks to its poor yield figures and now having to deal with an embarrassing scandal involving the aforementioned fake yield numbers and missing funds.

If a customer as big as Qualcomm can't trust Samsung's yield figures for cutting-edge process nodes, the only option it has is to switch.

Follow us on Google News

Things that are NOT allowed:

To help keep our community safe and free from spam, we apply temporary limits to newly created accounts: