Despite Google's ban, several apps provide short-term loans at ridiculously high interest rates

Last August, Google changed some Play Store rules to crack down on apps offering short-term loans often called "payday loans." These financial transactions earned this name because they are used by consumers who are living paycheck to paycheck and need to borrow some cash to take them to the next payday. In the financial markets, companies usually pay lower interest rates for shorter-term debt. But because consumers who need these loans are considered high-risk (not exactly worthy of a AAA S&P rating) and are desperate, the companies funding these apps are demanding outrageous interest rates.

Google denies turning a blind eye to apps offering short term loans with high-interest rates

So as we were saying, Google last year banned apps from the Play Store that offered loans of less than 61 days. The company said that it was looking to get rid of loans with "deceptive and exploitative" terms. But some apps offering short-term loans with annualized interest rates of 200% still can be found in the Play Store. And the lenders behind these apps are ignoring Google's rules by demanding that they be repaid in 60 days or less. Google spokesman Dan Jackson says that the firm is not turning a blind eye to these apps. "When violations are found, we take action," he says.

In the U.S., billionaire Mark Cuban's Dave app makes interest-free payday loans of up to $100

Reuters reports that these apps are very popular in Nigeria, India, and Kenya. The three are developing countries where many people own a smartphone but not a bank account or a credit card. One such app is offered by Branch International, a company based in San Francisco whose web site reads, "Our mission is to deliver world-class financial services to the mobile generation." The site also reveals how the firm conducts business. "Applying machine learning, Branch has created an algorithmic approach to determine credit worthiness via customers' smartphones. While this tech-forward approach requires transparency and trust, it also enables a fair, secure and convenient path for customers to build capital and save for the future."

Even though Google's Jackson says that no short-term loans can be offered on the Play Store, both Branch and another app called Tala say that they comply with Google's policies by offering both loans of 60 days and under and longer-term loans. Branch spokesman Mojgan Khalili says, "The 62-day loan is just one option, and they can choose shorter loans if they want." But some consumers complain that they want to borrow long term and aren't being allowed to. This type of bait and switch practice is even found with a money lending app offered by Opera Ltd. Yes, this is the same company behind the Opera browser apps. While Opera's lending app says that longer-term loans are available, customers say that this claim is not true. Additionally, Opera's loans carry an interest rate as high as 300% annualized. Google recently booted one of Opera's lending apps off of the Play Store although it has since returned. For its part, Opera says that it complies with Play Store terms.

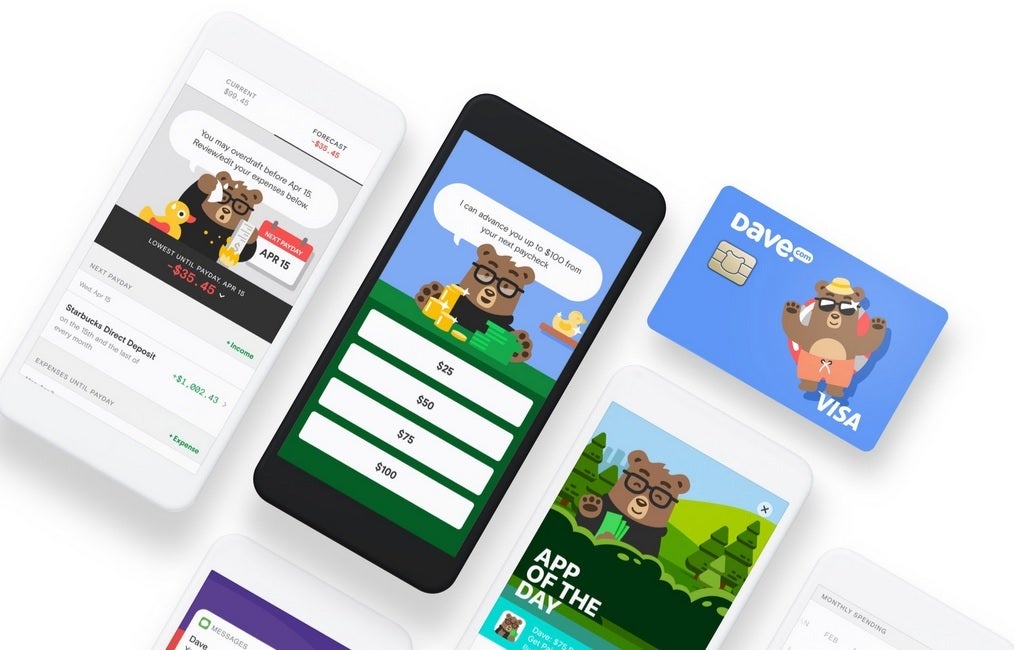

In the U.S., an app called Dave offers a payday loan of up to $100 with no interest and no credit checks. However, to use the app you must pay a $1 membership fee each month. Based on the average $34 overdraft fee that U.S. banks charge, paying $1 a month for a Dave membership seems quite reasonable. In addition, the app also does a number of other things to help you earn money and will even help you get a "side hustle" with companies like Uber and DoorDash. One of the investors in David is billionaire Mark Cuban. The app can be downloaded from both the Google Play Store for Android users and the App Store for those with an iOS device. Comments written by users on the Play Store for Dave are favorable although it is noted that to get the loan instantly an extra $4.99 payment is required. Otherwise, the funds requested will arrive in three days.

Follow us on Google News

Things that are NOT allowed:

To help keep our community safe and free from spam, we apply temporary limits to newly created accounts: