Mobile Competition Part 2: Great Artists Steal

In all likelihood, this piece of the Mobile Competition series won't be the same kind of opus as Part 1, because this time around we don't need to explain the pros and cons of each system. In part one, we laid out and organized the pieces of the puzzle, this time around we're putting the puzzle together and seeing how it all fits. We've explained the first point we wanted to make, which was that there is no "best" mobile OS, there is just what's best for you. This time around, we're going to expand on that, because in the fervor to crown a king of the hill, we tend to forget that all of the players are pushing each other up that hill. As we said in Part 1: quality becomes ubiquitous by the nature of competition.

The name of the game

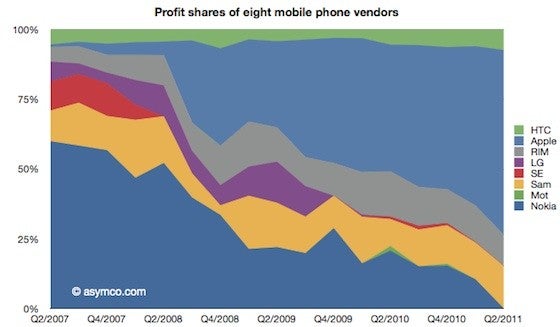

To start this off, we need to reiterate something that we've tried to explain in the past: while the mobile space is a competition, not everyone is playing the same game. This is a very important distinction to make, because often we like to point to numbers as the ultimate indicator of performance, and therefore the ultimate indicator of who "wins." Unfortunately, it's hard to name a winner when companies aren't playing for the same numbers. So, who is playing for what?

On the other hand, Google and Microsoft are both software companies; and, the path to profits as a software company is through market share. Of course, even though both are playing for market share, they still aren't playing the same game, because Google had a 3 year head start in the modern smartphone race (for which Windows Mobile was a non-entity), and Microsoft is still playing catch up, both in OS features and market visibility. Beyond that, Google doesn't charge any licensing fees for the use of Android. Google only makes money through the Android Market (which devices aren't required to use), and ads, both in-app and through the browser. Google wants Android on every device because the vast majority of those devices will keep Google search as the default, which means all searches will lead to Google ads. The trouble that Google is running into, as we've explained, is that more and more a content library is a necessity in pushing a mobile platform, especially when expanding into the tablet side of things. This is why we've seen Google pushing to get into the TV space through Google TV deals with content providers, as well a continuing to bid for Hulu and its video library. Although Android is expanding its lead in market share right now, Google understands how fickle market share can be, and needs to keep evolving its product.

To round out the competition space, we have the various manufacturers, which choose the best platforms to serve their needs and occasionally create in house platforms in an attempt to replicate the models of Apple or Microsoft. But, try as they might, right now the mobile OS space is a two-horse race between Apple and Google. That can certainly change and likely will, but it will be a relatively gradual change. However, the mobile space is not just the software, but the hardware as well, and in that regard every company contributes to the circle of competition.

The article continues on Page 2.

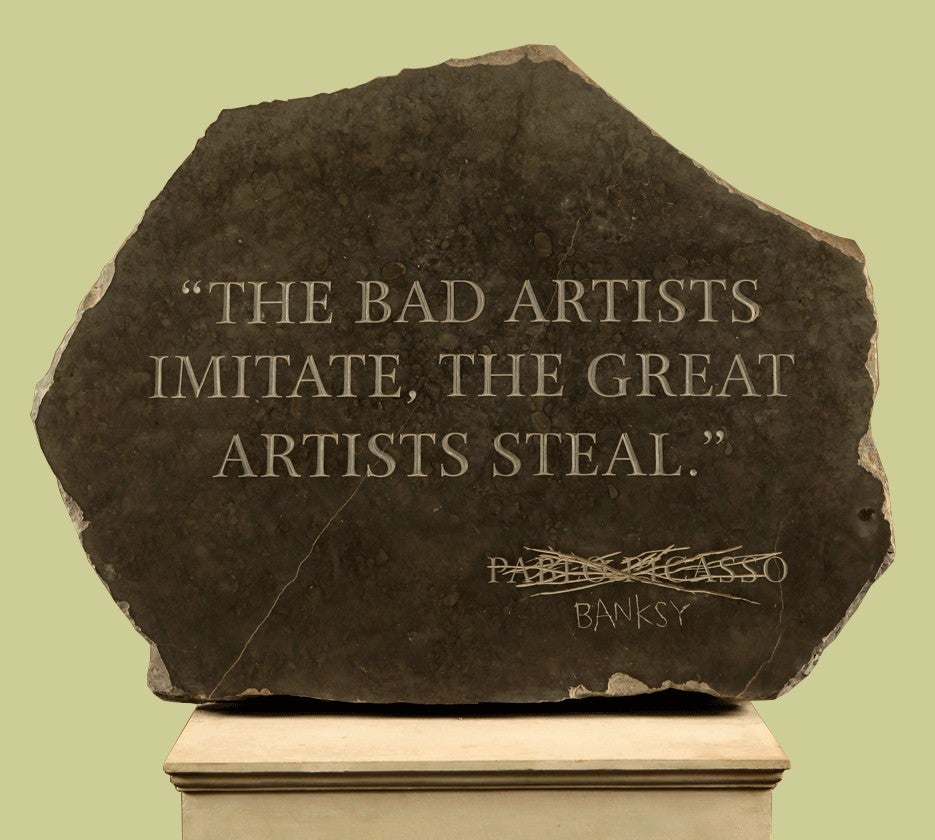

"Good artists copy, great artists steal."

As we mentioned before, quality becomes ubiquitous by the nature of competition. Because of this, one of the most pointless arguments we see going around the forums and comments is that "company X stole this idea from company Y". The absurdly broken patent system in America has been perverted and lost its way, and the path it has taken has fundamentally warped our view of what an idea is. The original point of the patent system was to force inventors to make their methods public, because ultimately, information wants to be free. The idea was that with processes in the public record it would be easier for other inventors to build upon that design and fuel more innovation. You may notice that while our current patent system tends to stifle innovation by asserting that ideas are not free, but are the property of whomever filed a piece of paper with that idea on it. On the other hand, the open-source system has continued in the spirit by which the patent system was first conceived: information is free, and innovation is driven by sharing.

It will often feel as though Apple is "stealing" more features from Google, but really that is just an illusion of the two company's development method, which we touched on in Part 1. Google is in love with the public beta. Every service and product it releases begins life as a beta, because Google wants to have the users to be a part of the building process. With this in mind, Google releases features and products much faster, but also less fully developed. Apple uses the successes and failures of other companies to inform its choices, and makes sure that when it launches a new product, it is full featured, matured and ready for prime time. This means that Apple spends more time working on a product or feature and often releases later, making it seem as though it took the idea from Google. The difference is just that Google likes to improve its products with the help of consumers, and Apple wants to cultivate an auteur air about its products as if they all came straight from Steve Jobs himself. Neither approach is better than the other as consumers often fall into the two camps of early adopters and those who prefer matured products, but they do lead to this common misconception.

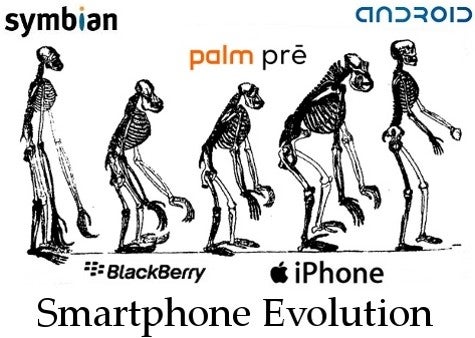

Apple kickstarted the modern smartphone boom and set the original trends. Google took stock of Apple's best ideas and used them to improve Android. Steve Jobs accused Google of stealing the "look and feel" of the iPhone (regardless of whether Apple may have stolen that look and feel from Samsung or Palm or some other company). Google then improved upon the iPhone features with its own innovations. Now, we're swinging back the other way where both Android and WP7 have far better notification systems. So, Apple is taking that and other better ideas, incorporating them to make its product better, and likely improving upon those ideas as well as some of the shortfalls of Android and WP7. We certainly wouldn't be surprised if iOS 6 includes some variation on widgets/Live Tiles that includes some ideas Google and Microsoft wish they'd thought of, because that's the circle of competition. We really hope that when that happens, Google and Microsoft take those ideas and make their products better. This is a virtuous cycle that only serves to make all of the products available for consumers better - the best ideas spread and cause the whole system to evolve. It doesn't matter who comes up with an idea first as long as the best ideas become the standard, because ideas strive to be free and to be shared. The greatest artists may "steal" from one another, but when everyone benefits from it seems far better to say that great artists "share" with one another and build upon each other's works. The evolution image above shows a direct line ending with Android, but in reality the iPhone and Android will be trading that top spot back and forth until a competitor comes along and evolves past both.

Conclusion

Just as each hardware manufacturer in the Android ecosystem pushes the others to make better handsets, so too do Android handsets and other devices push Apple to make better iPhones, and Apple pushes Android manufacturers, Google, Microsoft and others to make better products. Each company has its own business plan which guides decisions and pathways. Each company is striving for a different result, or attempting to reach those goals through different means, making it impossible to say whether one is better than another. At this moment, both Apple and Google are winning, because each is succeeding in the goals they have set: Apple is making huge profits, and Google's Android is running away with market share. Everyone is taking ideas from each other, because that's what needs to happen with the best ideas. The best ideas become ubiquitous because competition dictates its necessity in order to continue the evolution of technology. Once the best ideas spread and become standards, the market has no choice but to innovate; and, regardless of a broken patent system, innovation is still occurring on all sides. All sides are making great products, striving for separate goals, and competing in an unwinnable game. It's a game that can't have a winner, because it's a game with no end, and you can only have a winner when you've finished the game. Quality begets quality, great ideas become ubiquitous, and the entire ecosystem evolves. When that happens, it can be nothing but a good thing for consumers.

Addendum: There have also been many of you who have commented to the point that Apple tends to use unfair practices. The general complaints are that Apple acts like a bully in the market, taking ideas from others, but complaining and being overly-litigious when it feels that others have taken its ideas, and also that Apple ignores its customer's demands and routinely delays or doesn't bring certain features like copy/paste, or widgets. While these may not seem like the best business practices as far as keeping customer loyalty, they are in no way illegal, and ultimately are the choice of Apple to make. If Apple believes it can bring a device to market that doesn't have feature parity with competing devices, but still sell as well as it projects, that is Apple's decision. As much as we may want it to be different, Apple has no real responsibility to its customers, only to its shareholders. So, if we keep buying, Apple will keep doing the same things. As far as the lawsuits, we aren't sure why Apple would do that. Perhaps, it's a matter of making more noise about someone potentially stealing from Apple, so Apple devices continue to look unique. Or, it may be a tactic to slow down the market in order to control the pace of innovation, which would be beneficial to Apple because of its strict yearly update cycle. Whatever the reasons, they are Apple's choice to make and up to consumers to determine if Apple should be rewarded for them. As it stands, many people don't seem to care about Apple's business practices as long as it keeps putting out great devices.

image via MacRumors

Follow us on Google News

Things that are NOT allowed:

To help keep our community safe and free from spam, we apply temporary limits to newly created accounts: