Cell phone taxes and fees reach all-time high, here are the worst states

Tax policy experts from KSE Partners have spent five years collecting data about federal, state and local taxes in your cell phone bill.

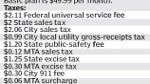

On average north of 16% of your bill from AT&T, Verizon, Sprint and T-Mobile goes to taxes and fees, compared to 7.4% for other goods for taxation. This rate has climbed up three times faster than the one on other goods and services in the three year period 2007-2010, since the financial crisis hit, and now we have an all-time high percentage of taxes and fees collected with our monthly bills.

The states with the highest rate are: 1. Nebraska: 23.69%, 2. Washington: 23%, 3. New York: 22.83%, 4. Florida: 21.62%, 5. Illinois: 20.90%, 6. Rhode Island: 19.67%, 7. Missouri: 19.28%, 8. Pennsylvania: 19.13%, 9. Kansas: 18.39%, and 10. Texas: 17.48%

States that have the lowest wireless taxes and fee ratio are as follows: 1. Oregon: 6.86%, 2. Nevada: 7.13%, 3. Idaho: 7.25%, 4. Montana: 11.08%, 5. West Virginia: 11.28%, 6. Delaware: 11.30%, 7. Louisiana: 11.33%, 8. Virginia: 11.61%, 9. Alaska: 11.74%, 10. Connecticut: 12.01%.

via PCMag & KPAO

On average north of 16% of your bill from AT&T, Verizon, Sprint and T-Mobile goes to taxes and fees, compared to 7.4% for other goods for taxation. This rate has climbed up three times faster than the one on other goods and services in the three year period 2007-2010, since the financial crisis hit, and now we have an all-time high percentage of taxes and fees collected with our monthly bills.

via PCMag & KPAO

Follow us on Google News

Things that are NOT allowed:

To help keep our community safe and free from spam, we apply temporary limits to newly created accounts: