Trade war could force the price of the Apple iPhone XR to be hiked by $160 says analyst

As reported today by the BBC (via AppleInsider) the White House announced this morning that it has increased tariffs on $250 billion of products imported from China to 25% from 10%. Since Apple devices were not on the original list of affected products, the company continues to escape any direct hits from the U.S.-China trade war (more on that later). However, what happens next will decide whether U.S. consumers end up paying more for their iPhones. The president has said that he would hit another $325 billion of Chinese imports with a 25% tax if the two countries can't come to an agreement. That group of products would most likely include the iPhone.

While Apple designs its products in the U.S., the actual assembly is done in China by companies like Foxconn and Pegatron. Thus, these devices are considered to be imported from China. Apple does have some manufacturing options in other countries, including India where it produces the iPhone 6s and iPhone 7.. But it probably would result in a huge production cut, and might not totally get Apple off the hook. After all, the company sources some parts from China.

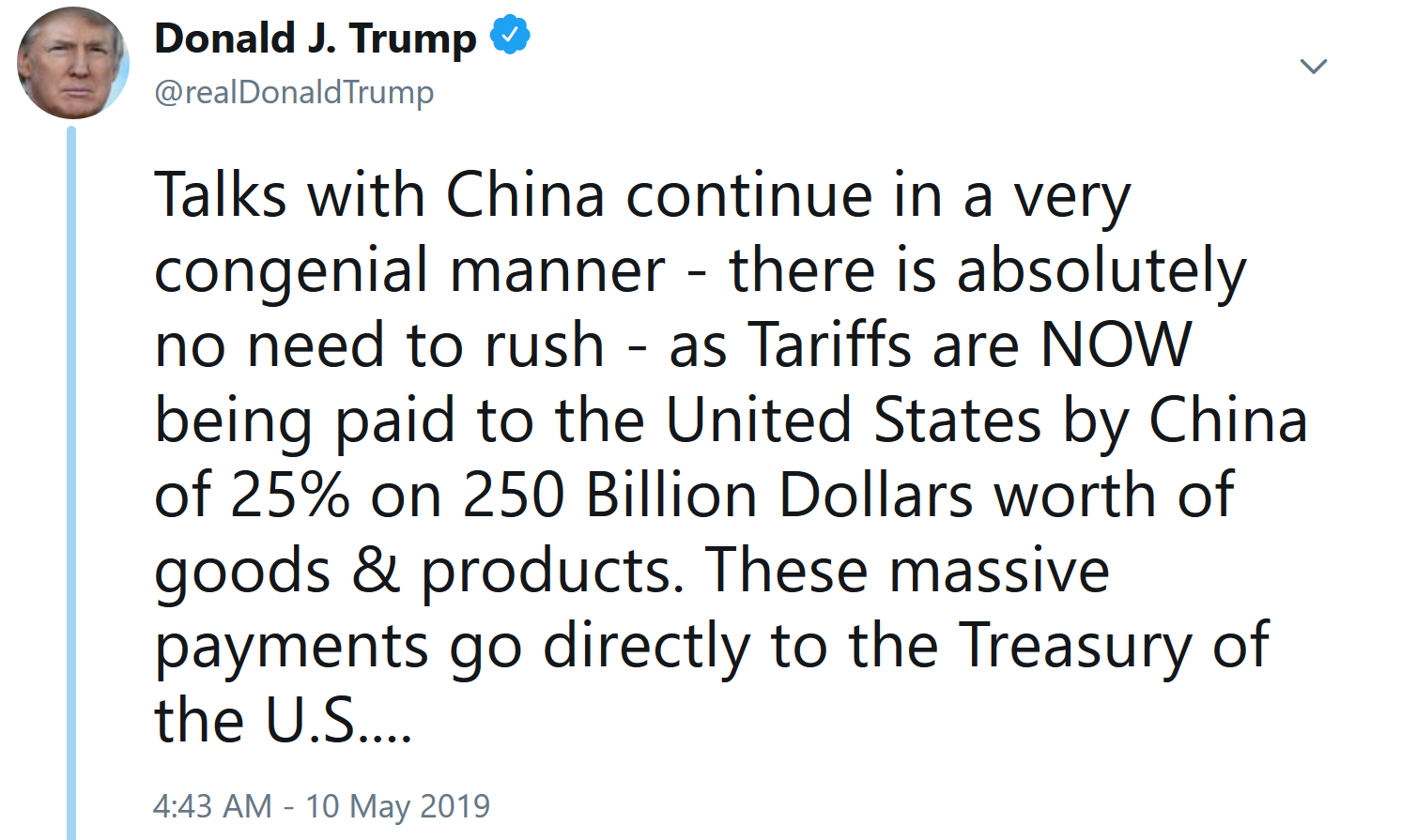

In what might be considered good news for Apple, a tweet disseminated by the president this morning indicated that he is in no rush to add the additional tariffs. Trump wrote, "Talks with China continue in a very congenial manner - there is absolutely no need to rush - as Tariffs are NOW being paid to the United States by China of 25% on 250 Billion Dollars worth of goods & products." We should point out that the last part of the tweet is factually incorrect. No money is being paid by China to the U.S. as it is American consumers and businesses that must absorb the tax. And that means that if Apple does get included in a new round of tariffs, the company would have two options. It could leave the price of the iPhone as is and take a hit to its margins, or raise the price of its phones by the amount of the tax. Morgan Stanley's team of analysts led by Katy Huberty says that if Apple is included in the next wave of tariffs, the iPhone XR could see its price raised by $160 in the U.S. Huberty says that this could not only hurt demand for the phone, it would also stretch out the already rising upgrade cycle.

Apple is getting hurt by the weakness in the Chinese economy, which is an effect of the trade war

During the campaign and into his presidency, Trump has tried to get Apple to move some of its production to the states. Last September, the president tweeted "Apple prices may increase because of the massive Tariffs we may be imposing on China-but there is an easy solution where there would be ZERO tax, and indeed a tax incentive. Make your products in the United States instead of China. Start building new plants now. Exciting!" In July 2017, Trump said he was told by Apple CEO Tim Cook that the company was planning to construct "three big plants, beautiful plants." Sounds good, but Apple denied that the exchange between the two executives ever took place.

Apple manages to avoid tariffs for now

While Apple hasn't directly been hurt by the tariffs, it has suffered from the weakened economy in China that is a result of the trade war. During Apple's fiscal second quarter, which covered January through March, the company saw revenue from China decline 22% from $13.02 billion to $10.22 billion on a year-over-year basis. Besides the trade war, Apple was hurt by the strength of the U.S. Dollar against the Chinese Yuan. This forced the company to hike iPhone prices in the country to maintain its margins. As a result, in China, the "more affordable" iPhone XR was priced higher than the Huawei Mate 20 Pro. Eventually, Apple cut its wholesale prices in China and cut its retail prices by up to 6% last month. But that second price cut was made after China dropped its value-added tax (VAT) for manufacturers to 13% from 16%.

Follow us on Google News

Things that are NOT allowed:

To help keep our community safe and free from spam, we apply temporary limits to newly created accounts: