Qualcomm's new CEO says Huawei chip ban adds much needed capacity at TSMC

According to a report from Bloomberg, Qualcomm's incoming Chief Executive Officer Cristiano Amon says that U.S. sanctions against Huawei will help alleviate a global chip shortage. Currently, Huawei's in-house chip design unit HiSilicon cannot get its designs manufactured by foundries because of the U.S. export rule change that took effect in the middle of last September. Under the new rule, foundries world-wide that use U.S. tech to manufacture semiconductors cannot deliver them to Huawei without consent from the U.S. Commerce Department.

Huawei's chip ban will help prevent a global chip shortage

Because of this rule change, Huawei, which was once the second-largest customer for TSMC, the world's largest contract foundry, can no longer buy chips from that manufacturer. This has opened up some capacity for TSMC, Amon said; the foundry has seen reservations for chip production run pretty full. While we tend to think of these chips as the brains for the smartphones, tablets, and smartwatches that we all adore, complaints about chip shortages have been made recently by automakers.

Qualcomm introduces its 4nm Snapdragon X65 5G modem chip

While Qualcomm is not allowed to provide Huawei with chips, it can provide these components to Huawei's former sub-brand Honor. Huawei sold the latter to a consortium back in November for a little over $15 billion. Qualcomm is selling chips to some other Chinese phone manufacturers and these companies, like Xiaomi, have seen strong gains in market share. In fact, during the fourth quarter of 2020 Xiaomi had the largest annual gain in chip purchases at 26%. The firm is now the third largest smartphone manufacturer in the world and the year-over-year gain was the highest among the top 10 purchases of semiconductor chips in the last quarter of 2020.

Amon, who soon will be Qualcomm's CEO, says that Qualcomm has been experiencing heavier than expected demand. Bloomberg's report cites strong rebounds in certain tech products that are powered by the high-powered chips like those designed by Qualcomm. Demand is rising for PCs, home networking equipment, and vehicles. The executive says that any reduction in HiSilicon chip production won't immediately turn into additional chip production from other foundries. That is because transferring the production of chip designs to a new manufacturer takes time. The incoming CEO adds that finding a solution to the U.S.-China trade war will take some time and the semiconductor part of the dispute will take the longest to resolve.

Qualcomm is in favor of companies opening foundries in the states. After all, Qualcomm is a U.S. firm headquartered in San Diego. Both TSMC and Samsung Foundry will be building additional capacity in the U.S. over the next two to three years. Qualcomm also would not object to giving production orders to Intel if the latter ever decided to open its foundries to contract manufacturing. Ironically, Intel has outsourced some of its chip production this year and TSMC will be building these chips.

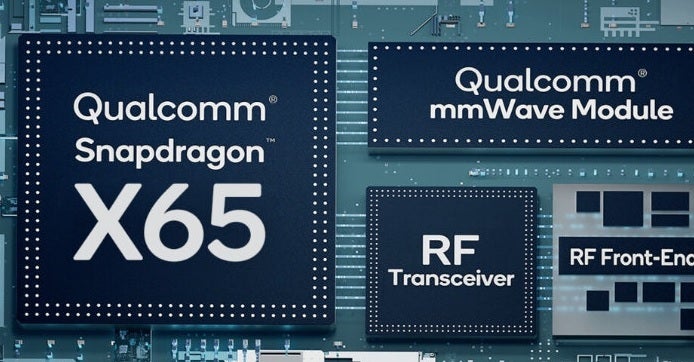

Chip demand over the last two years has been led by the fives: 5G, and 5nm. The latter is the process number used to produce cutting-edge chips and is based on the number of transistors that can fit inside a square mm. TSMC and Samsung Foundry are now churning out 5nm chips that are more powerful and energy-efficient than any previously available chipsets. 5G modems are needed to help smartphones connect to the 5G networks that are being built out. In fact, today Qualcomm unveiled its new flagship 5G modem, the Snapdragon X65 5G. This is the component that will most likely be used to connect 5G networks with the 2021 iPhone models. Samsung Foundry will be manufacturing the 5G modem chip using its 4nm process. The modem will support download data speeds of 10Gbps. The chip supports all of the bands that contain 5G signals now and in the near future.

Follow us on Google News

Things that are NOT allowed:

To help keep our community safe and free from spam, we apply temporary limits to newly created accounts: