Xiaomi's market share soared last year in the EMEA region while Huawei's slice of the pie collapsed

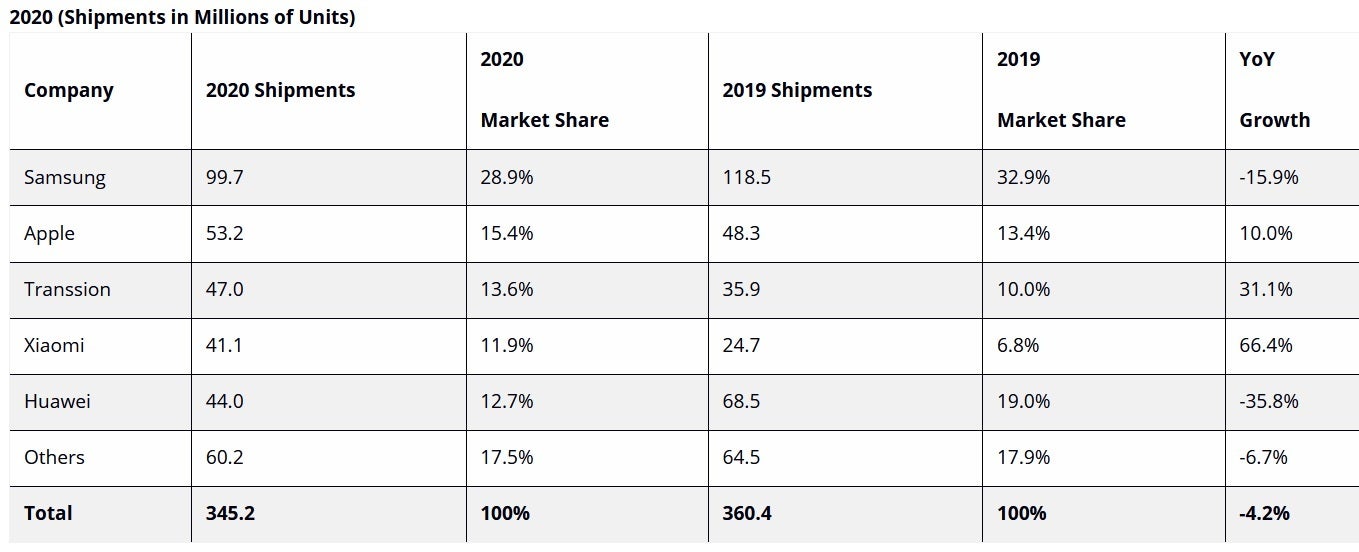

According to IDC, last year's shipments of smartphones in Europe, Middle East and Africa (EMEA) was the weakest in six years due to the COVID-19 pandemic. For the year, 345.2 million units were shipped in the region, a 4.2% year-over-year decline. Based on value, $110 billion worth of phones were delivered last year in EMEA. In Europe, the number of phones shipped in 2020 amounted to 195.2 million units for a 4.9% decline. The value of phones shipped in the continent last year was $82.4 million, down 3%.

In 2020, Xiaomi had the strongest annual gain in EMEA smartphone shipments while Huawei had the largest annual decline

Zdenek Krouzel, program manager at IDC EMEA, said, "If you just looked at the topline numbers, you might think it was a typical year with a bit of an economic wobble, not one with a pandemic and months of national lockdowns, leading to a yawning economic downturn."

Samsung was the top smartphone brand in the EMEA during 2020

IDC EMEA Research Manager Marta Pinto said, "Across Europe, consumers switched quickly to buying online when phone shops closed in spring 2020. The phone business did not get the same boost from home working as the PC market, but clearly consumers were valuing their phones more as they coped with the new stresses of living mainly within the same four walls."

IDC says that the average pre-tax price of an Android phone in Europe dropped 8.5% last year to $278. On the other hand, the average sale price of an iPhone in Europe rose to $894. Apple had a strong 2020 in Europe with its best fourth quarter ever.

The top smartphone brand in the EMEA last year was Samsung despite a 15.9% year-over-year decline in annual shipments. Sammy's market share declined on an annual basis from 32.9% to 28.9%. For the year, Samsung shipped 99.7 million handsets in the region. That topped Apple whose 53.2 million units shipped in the area was a 10% year-over-year gain and gave the company a 15.4% slice of the pie. Transsion delivered 47 million handsets in EMEA last year for a 13.6% market share, up 31.1% year-over-year. Number four Xiaomi and number five Huawei had the largest year-over-year gain and decline respectively. Fourth place Xiaomi, which has moved to third place in the global charts, saw its EMEA shipments soar 66.4% on an annual basis to 41.1 million units. Huawei's 35.8% year-over-year-decline dropped its EMEA shipments from 68.5 million to 44 million units during 2020. Huawei's results were impacted by the continued placement of the company on the U.S. entity list preventing it from accessing its U.S. supply chain for a second consecutive year. It also was impacted by the change in export rules that prevents global foundries using U.S. technology from shipping cutting edge chips to Huawei. Xiaomi has been taking market share from Huawei while Samsung remains on top.

IDC expects to see marginal growth in European smartphone shipments this year in both units and volume. The Android platform will remain competitive as brands battle to take over the share of EMEA business formerly owned by Huawei. Besides having to deal with U.S. restrictions on the company, Huawei also decided to divest itself of its Honor sub-brand as a way of preventing Honor from getting punished by the U.S. because if its connection to Huawei. The latter took in $15 billion in the transaction.

IDC blamed the pandemic for stunting the growth of 5G sales in Europe last year. Sales of the latest generation of wireless connectivity made up only one-tenth of smartphone sales in Europe during 2020. The Q4 number of 5G phones shipped in Europe rose thanks to the release that quarter of the 5G Apple iPhone 12 series. For this year, IDC expects one out of every four phones shipped in Europe to be 5G enabled. That would be 25% of the market and a huge rise from last year's 10% share.

Follow us on Google News

Things that are NOT allowed:

To help keep our community safe and free from spam, we apply temporary limits to newly created accounts: