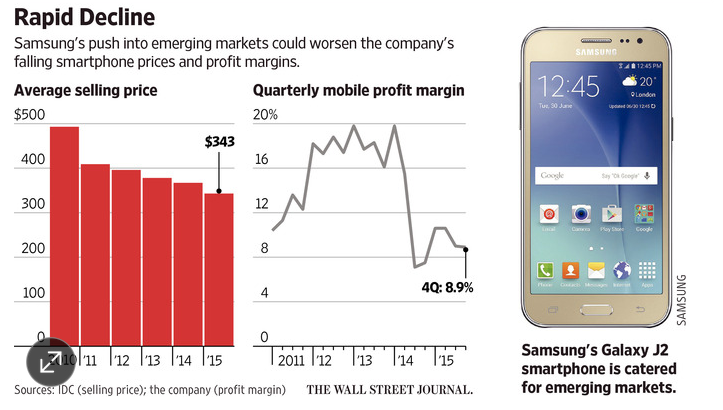

WSJ: Samsung winning back customers in emerging markets, but at a cost

As Samsung cuts prices in emerging markets, sales rise but margins drop

Samsung is looking to recapture the throne it once sat on as the top smartphone manufacturer in emerging markets. In countries like China, India and Indonesia, Sammy lost its leading position in 2014 and 2015. But a simple strategy is helping the company regain lost ground. By cutting the price of its handsets, Samsung is attracting business in emerging markets like it used to. For example, the low-priced Galaxy J series gives buyers some of the features found in the manufacturer's high-end models, but is priced much lower starting at $130. However, this strategy does come at a cost.

The one area it can control quicker is pricing. Samsung's phones now cost 25% more than locally produced budget phones in India, down from 40% previously. While lower prices might help Samsung become the top smartphone manufacturer in emerging markets, it will need to work on its margins or else cutting prices will be like digging its own grave.

Follow us on Google News

Things that are NOT allowed:

To help keep our community safe and free from spam, we apply temporary limits to newly created accounts: